5 reasons to avoid joining Robinhood

Finding a mobile-friendly app for IRAs and stocks doesn't outrank human customer service

Update on March 5, 2025: I have just been made aware that Robinhood Markets gave $2 million to Donald Trump’s campaign. The few months I was signed up with Robinhood were unimpressive. I do not recommend Robinhood nor Stash to anyone.

Update on February 18, 2024: For the past few months, I have been using Fidelity and have had none of the problems I used to. Not only do I enjoy their weekly tutorials and the diversity in topics and people for their YouTube videos, but their website and app are easy to use. (The video about Medicare helped me assist a relative with her sign-up questions and fact-check a few financial posts.) I wish I would’ve started with Fidelity in the first place.

Update on December 10, 2024: All I can do is shake my head. About 24 hours after writing this post — and multiple weeks of no response on my own — I suddenly get a live chat rep immediately after one message, an email to ask me what I do and don’t like about Robinhood, and an email confirmation that my IRA account was finally closed. Maybe it’s coincidental. All I know is I shouldn’t have had to write this to get Customer Service reps to respond to me. Whatever works, I suppose.

In a tech-centric world where picking up your mobile app is one of the easiest ways to get your investment started, apps like Robinhood seem like an easy choice for starting your own individual retirement account (IRA) and testing the waters with stocks. User friendly and (usually) quick to initiate, Robinhood’s app is so convenient that you don’t have to worry about holding to speak to a human being. And that works out just fine — until you actually do need to speak with a human being.

Recommended Read: “Americans and our indifference to rude customer service ~ When rude employees at the gym saved me money”

The truth is I never intended to open a Robinhood account. I thought Kevin Hart’s friend Spank did a pretty good job of explaining the perks of investing on “Straight from the Hart.” I don’t recall why I chose Stash instead of Robinhood, and if not for a marketing clash a few years later, I would still have a Stash account.

Recommended Read: Amazon Associates versus Impact Marketing: Which is better? ~ From Medium to Substack: Choosing between allowing ads versus focusing on subscriptions

I don’t play video games nor have I ever been in GameStop, so that GameStop versus Robinhood debacle meant nothing to me. But there are five things I wish I knew before I joined Robinhood.

ADVERTISEMENT ~ Amazon

As an Amazon affiliate, I earn a percentage from purchases with my referral links. I know some consumers are choosing to boycott Amazon for its DEI removal. However, after thinking about this thoroughly, I want to continue promoting cool products from small businesses, women-owned businesses and (specifically) Black-owned businesses who still feature their items on Amazon. As of the first date of Black History Month 2025, each new post will ALWAYS include a MINIMUM of one product sold by a Black-owned business. (I have visited the seller’s official site to verify that Amazon Black-owned logo.) I am (slowly) doing this with older, popular posts too. If you still choose to boycott, I 100% respect that decision.

1. Their referral links don’t always work for new members, and they may be rejected at random.

Imagine my surprise when I tried to move my own mother’s account from Stash (for the same reasons mentioned here) to Robinhood and she was immediately rejected. No matter how many times I tried, the app said she didn’t meet the qualifications as a U.S. citizen, didn’t have a valid Social Security number and/or wasn’t a resident in one of the 50 states. Meanwhile, my African-American mother was born and raised here, has been a homeowner for 50 years, and won’t stop calling her childhood state “Loo-ze-an-na” instead of “Loo-ee-zee-an-na.” She is definitely from here. Even a Better Business Bureau complaint and a scanned driver’s license was ignored when I tried to find out why she was rejected.

ADVERTISEMENT ~ InVideo

Did you like the video above? Would you like to create your own artificial intelligence video FOR FREE? Click the banner below. Or, click here for more details on paid subscriptions!

2. Calling Robinhood is harder than finding Carmen San Diego and Waldo.

If you want to call them to resolve an issue, good luck being able to get past all of the automated navigation and artificial intelligence FAQs to even get to a phone number. And when you do get to a phone number, expect the screen to immediately go to an “agent” contact screen anyway.

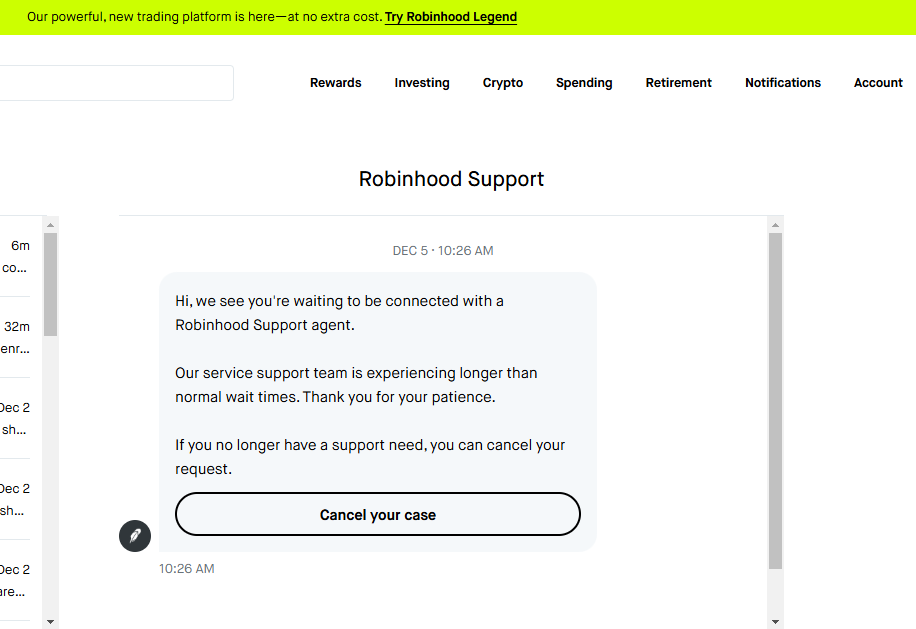

3. Agent wait times may say “3 minutes” but take around 15 hours for a reply.

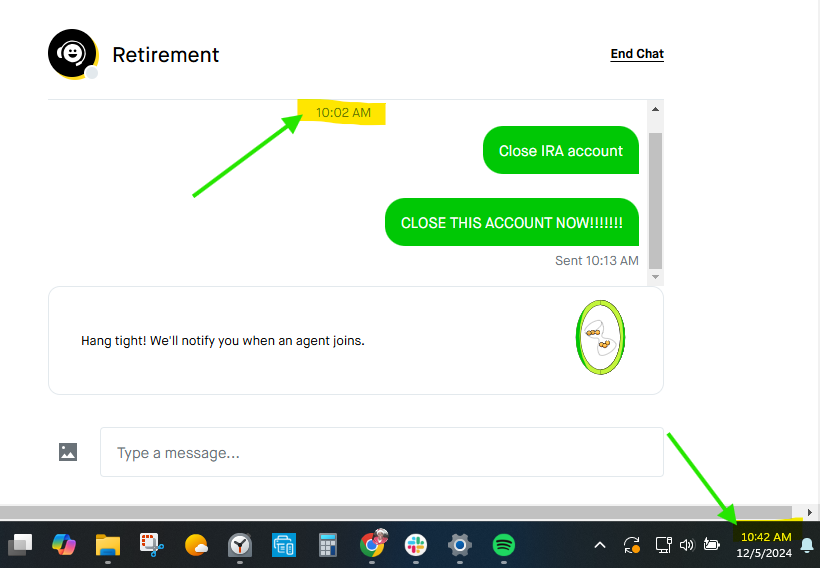

There’s no other way to explain it: Robinhood is trying to stall you out from closing your account. Try to close the IRA account, and it’ll immediately take you to an agent screen. As of October 24, 2024, Robinhood has 24.3 million funded customers and 11 million monthly active users. The app either cannot handle Customer Service for this many people or hopes you’ll grow so frustrated and bored with closing your account that you will change your mind.

Recommended Read: “New To Investing And Thinking About Investing In AI? Here's What To Know”

Jumping through this level of hoops has only doubled the grudge I’m holding against this site and to get away from it as quickly as possible. And when an agent does respond, there’s no email alert nor Chrome tab alert to let you know there’s a response. You just have to keep that tab open and look back every blue moon to see if someone responded. Expect the reply to come at oddball hours, immediately point out how you haven’t responded in the dead of night and then close the conversation out.

4. Robinhood will not respond to requests to transfer your IRA to other platforms.

Although Robinhood will be happy to remind you of their $75 fee to transfer your prior IRA funds to them, expect a questionable lag in response or complete silence if/when you start an IRA account with a different company (that has human beings you can talk to). After starting a new IRA and investment account last week with a third company, Robinhood has not made any effort to allow my IRA funds to be transferred to this company (which charges $0 for the transfer).

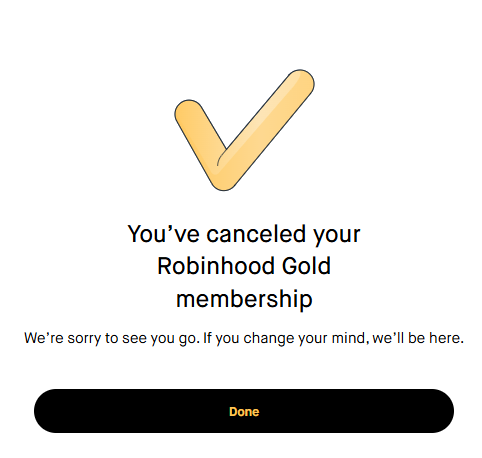

That left me with deciding whether I’d rather wait for Robinhood to try to charge me for the Robinhood Gold membership another month (which you oddly cannot cancel on a mobile device and I found out by accident works OK on a computer), risk giving up their 3% contribution to my IRA and pay the early withdrawal fee. Even with Stash’s horrible service with marketers and social media influencers, they weren’t this bad when it came to closing an account. I spoke with a human being, and the accounts were promptly closed. I gave in, gave up Robinhood’s 3% contributions (which is fair since I’m leaving), agreed to the federal early withdrawal fee before the age of 59-1/2 and after all that — Robinhood still sent me to a virtual customer service screen.

Forty minutes is small change. This waiting time will be a full day — as it has been for the past few weeks while trying to ask other questions.

5. Robinhood will find new reasons why you can’t close your brokerage account just yet.

These steps to close your account wouldn’t be so curious to me if Stash dragged it out this long too; they do not. Waiting a few days for a cash sweep and upcoming dividends wouldn’t be such a big deal — if this hadn’t been a three-week process full of automated messages and an ignored BBB request. While you’re waiting on all of these steps to happen before closing the brokerage account, make sure to turn off any other withdrawals — daily/monthly investment withdrawals to stock companies, biweekly withdrawals to the IRA account, Robinhood Gold $5 monthly membership fee. Otherwise, you will have to wait all over again to withdraw money you just paid while collecting the pending funds too.

ADVERTISEMENT ~ Amazon

As an Amazon affiliate, I earn a percentage from each product purchased using my referral link.

If you don’t choose Robinhood (or Stash), which company should you choose?

There are at least 18 competitors of Robinhood, ranging from Fidelity to Acorn and onward. The perfect investment company for you may not be the best one for me. But before you invest in any of them, the primary lesson I’ve learned is:

Contact Customer Service for anything. It doesn’t matter what it is. The goal is to see what the wait time is, if you can have a productive conversation with this rep and that they don’t transfer you to a zillion other people.

Review the pros and cons of their competitors to see what you’re in for and who has perks you didn’t think of. NerdWallet giving Robinhood 3-1/2 stars in Customer Service is laughable. Investopedia gave a much more accurate depiction of how Robinhood membership actually is.

Read the FAQs on their actual site and follow them, making sure they don’t all go to dead links that haven’t been updated in eons.

Comparatively speaking, customer service at Fidelity and Robinhood is vastly different. Since there is no telephone number, you cannot call Robinhood for assistance. […] Additionally, Robinhood has a chatbot. Perhaps because of this web-only approach, Robinhood has not earned a good reputation for its customer service. -Investopedia “Fidelity vs. Robinhood”

Check out a few investment advice sites beforehand, and peruse consumer feedback sites like Reddit to see what other users have to say. (Be wary of users who are gushing nonstop about how perfect a company is. That is probably one of the company’s marketing reps.) Find an investment platform that works for your needs, even if they’re different from someone else’s. But no matter the platform you use, keep in mind that if it’s this much trouble just to ask a question before you are at an age where you should be receiving IRA funds and the benefits of investment stocks, just imagine what it’ll be like once you’re of senior age and actually need it.

Did you enjoy this post? You’re also welcome to check out my Substack columns “Black Girl In a Doggone World,” “BlackTechLogy,” “Homegrown Tales,” “I Do See Color,” “One Black Woman’s Vote” and “Window Shopping” too. Subscribe to this newsletter for the monthly post on the third Thursday.

If you’re not ready to subscribe but want to support my writing, you’re welcome to tip me for this post! I’ll buy a dark hot chocolate on you. Thanks for reading!